Yes, mobile payment operators are taking over. But there’s one thing they’re lacking: Access to banking services. That’s where banks can take advantage and offer Banking as a Service (BaaS). In fact, it’s gaining traction as a must have service. An estimated 1.2 billion people worldwide need financial assistance like savings accounts or insurance options. Banking as a service can provide that.

Traditional forms of banking vs BaaS

The traditional concept of banking has been disrupted as consumers embrace digital payments and app-based transactions. Consumers now expect improved customer relationship management capabilities, reduced costs, and personalized experiences.

Why it's a mutually beneficial model

The best BaaS models can help fintech companies achieve compliance while streamlining their overhead costs.

Banks can provide access to resources and provide an infrastructure that allows these newcomers on the financial scene to grow without investing in costly technology or hiring expensive personnel familiar with compliance regulations.

On the other hand, Fintech startups can help Banks with their security challenges. This adds a digital layer that allows for the seamless integration and connection of data across multiple systems.

BaaS can provide both banks and fintech startups with solutions to avoid costly manual processes.

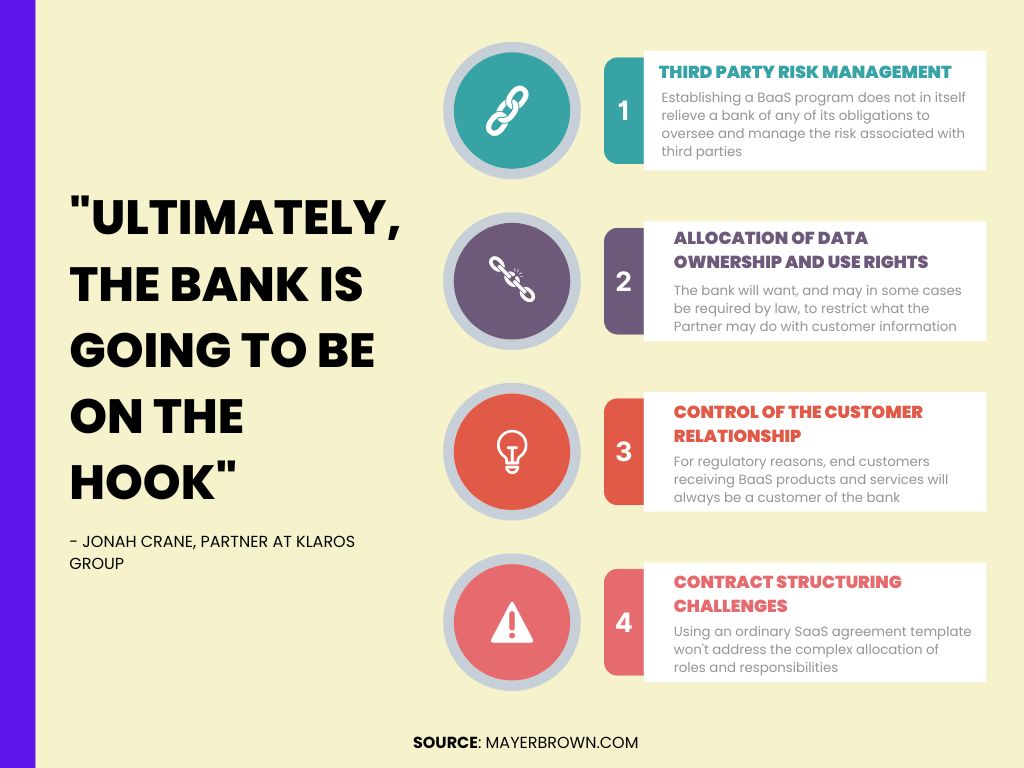

But what about regulations?

Regulations are starting to catch up with the rapid growth of BaaS. The OCC is starting to hold neobanks and fintech firms accountable for digital banking experiences.

So where is Banking As A Service going?

BaaS products offer more flexibility when compared to traditional banks.

Financial institutions now have the unique chance to acquire new customers and grow their revenue without breaking the bank. With BaaS, they can open up doors of opportunity that reach different demographics while delivering exceptional experiences tailored specifically for each customer’s needs.

By providing this level of personalized service, financial institutions will not only keep existing consumers satisfied but also gain potential new customers along the way.