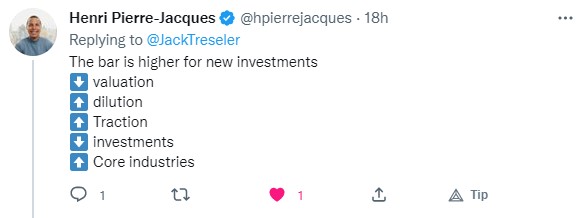

Ever since the NFT and Crypto market took a hit earlier this year, investors have taken a step back and took a critical eye to their investment strategies. Now, as Henri Pierre-Jacques (founding partner of Harlem Capital) puts it, startup owners are going to have higher standards to meet to get investments.

So how can startup owners work with investors who now seem to have made a 180 on their investment strategies?

First, it comes down to knowing what they’re thinking. Which is tricky because VCs are not typically known for their transparency when talking to startup founders.

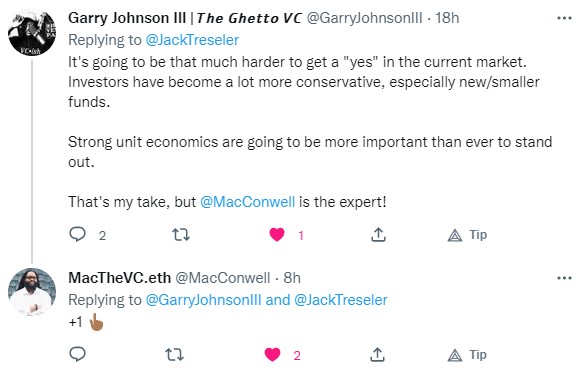

Based on feedback from VCs like Garry Johnson III -(check out his company’s swag, it’s amazing) and Mac Conwell, startup CEOs looking to raise capital will need to have a lot more quantifiable performance for them to feel comfortable investing.

That means showing traction (downloads, wait lists, or sales), as well as a good indication on future margins and ability to scale.

NOTE – just saying you’re “designed to scale” isn’t enough. You’ll need to back it up.

One of the other things you’ll want to do is cultivate a much stronger relationship with your current investors.

VCs are now more likely to invest in follow on rounds, doubling down on winners than they are to take a risk on a company they’re not familiar with.

Here’s a few things:

It’s a lot harder now to raise capital than it was before. You’ll need to show more traction and tangible upside. But don’t forget to lean into your soft skills (communication, service, asking for help) to help build the strong connections you’ll need to improve your chances at raising a round.