Women have made great strides in the financial industry, but female startup founders still face an uphill battle when it comes to funding from venture capitalists. In 2021 alone, companies run by women only received 2.4% of all capital invested in VC-backed startups – barely a blip on the radar! Caroline Winnett, executive director of Berkeley SkyDeck, a startup accelerator run by the University of California, Berkeley, suggests that these disparities can be attributed to how men and women view each other; having evolved over centuries with distinct neurological traits based upon our ancestral roles (men hunting animals while women held communities together). That hard thing to grasp is the gravity of gender inequality continuing right now, in 2023. We still have much work left if we are serious about achieving equity across genders and industries.

First step is to acknowledge (actually acknowledge this time) one key fact:

Assumptions get in the way

Investors often operate under the assumption that male founders will bring a higher return on investment, fueled by an idealized view of confidence and determination. It’s a common cultural belief that men take larger risks which may lead investors to believe they are better suited for founding companies.

But in reality, male founders benefit from the fact that 95% of general partners making the decision whether to invest in their startups are male.

How do we combat that?

We need more VCS (like The Artemis Fund) to invest in female founders such that 50% of its portfolio are made up of woman entrepreneurs.

Next, awareness needs to be increased regarding these existing female entrepreneurial forces – it’s time we recognize them as key players in driving innovation forward.

We also need to get rid of the common misconception that there isn’t a pipeline problem for women entrepreneurs.

There is.

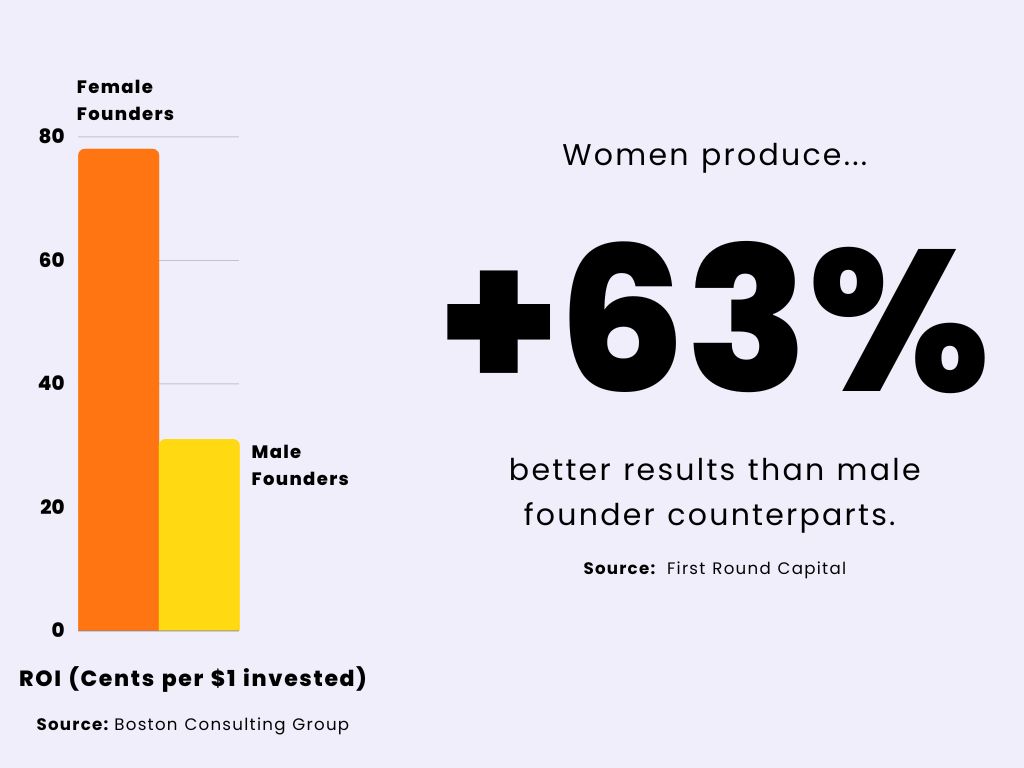

Results from Boston Consulting Group substantiate this. Startups launched by women generate 78 cents of return per dollar invested whereas male counterparts only give 31 cents.

Further proof comes from First Round Capital demonstrating companies founded by ladies come out 63% ahead than all-male founding teams. Pretty impressive stats at play here – sounds like investing in women pioneers definitely pays off.