Quick hits:

Why is machine learning important in FinTech?

How can AI help FinTech companies?

In fintech, machine learning can provide finance brands with faster and more accurate predictions, more thorough analysis of large data sets, and more efficient automations. This ultimately helps finance brands save time and costs.

How AI is being used in data analytics in fintech?

When data is gathered and analyzed by AI systems, the information can used to provide pertinent, pre-approved products and personalized financial advice.

Machine learning can help finance brands be more profitable and deliver better customer service.

One of the key roles of machine learning in FinTech is automation. Finance brands can are using AI-powered chatbots and virtual assistants to provide 24/7 customer support and answer questions. They also use machine learning to assist with basic financial tasks and more complex workflows.

This not only improves efficiency but also enhances the overall customer experience.

Why Machine Learning in Fintech

Machine Learning helps Fintech companies with daily operations in order to be more profitable and provide better services to their customers. It sounds generic, but in practice, machine learning makes the work behind the scenes much more efficient.

Machine learning uses algorithms, rather than a set of explicitly programmed instructions, in order to analyze information, make decisions and learn from those decisions. Over time, ML then modifies its own code, without human oversight, so it can make better, faster, and more accurate decisions.

Here’s an example: Loan Underwriting

Machine learning algorithms can analyze large data sets, and use that data to create more accurate and efficient loan underwriting models. This does two things:

- This can help fintech companies reduce the time and cost involved in evaluating loan applications

- By using the large data sets to refine who is approved for loans, machine learning algorithms can both widen who can qualify for a loan, and also ensure loan approvals don’t lead to defaults.

Benefits of Machine Learning in Fintech

Right now, a lot of the benefits in using machine learning in fintech stem from data analytics, predictive forecasting, and enhanced decision-making. A lot of the current benefits include:

- Improved financial decision making

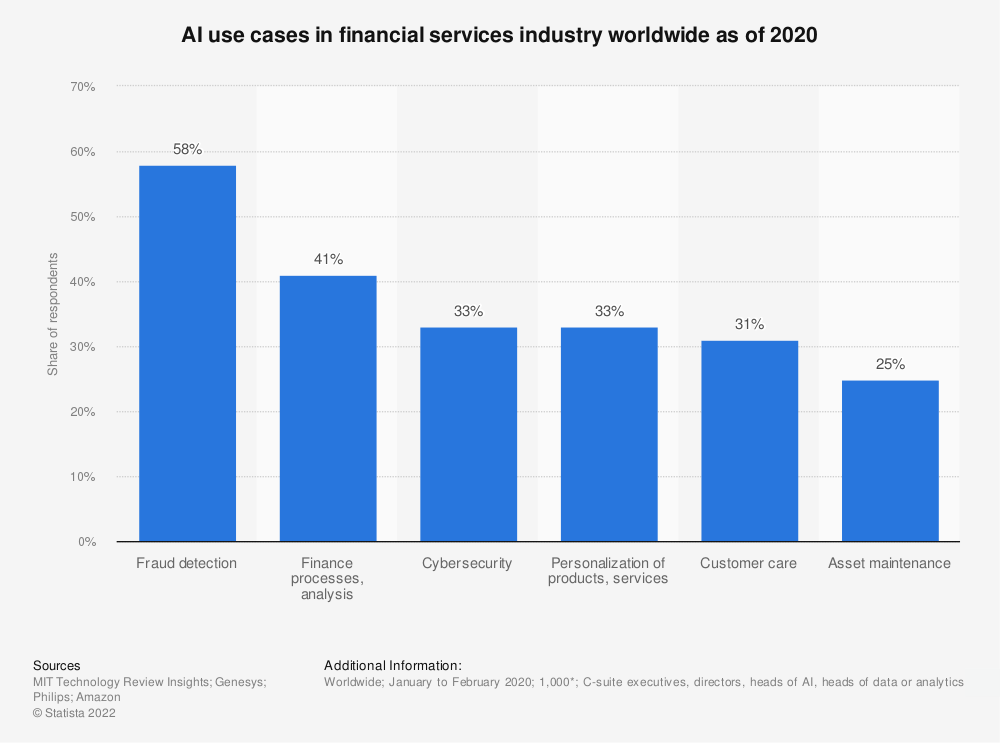

- Security & fraud detection

- Asset management

- Customer support

- Insurance compliance

- Loan origination

- Forecasts

- Personalization

Breakdown and examples of machine learning in Fintech

1. Fraud Prevention

One of the most critical applications of machine learning in fintech is fraud detection. With machine learning algorithms, fintech companies can effectively analyze transactions, spot unusual behavior, and signal potential fraud. By quickly detecting fraudulent activity, these companies can safeguard their customers’ assets and prevent financial losses.

2. Credit Scoring

Machine learning algorithms are better at assessing creditworthiness than just what a credit score can tell a business. By analyzing data from diverse sources, these algorithms generate more precise credit scores that better predict whether an applicant will default on a loan. This empowers fintech companies to make informed lending decisions.

3. Portfolio Management

By analyzing market trends, risk factors, and other key data points, these advanced algorithms optimize investment strategies, delivering better returns for customers while effectively managing risk.

4. Compliance Monitoring

By leveraging machine learning, Fintech companies can steer clear of costly fines and penalties. By combining the regulatory rules with machine learning algorithms, you can create a system that can learn from data while staying within the rules.

5. Algorithmic trading

Companies can use machine learning to streamline financial decision-making and boost trade volume. If you give self-learning machine learning algorithms specific trade orders and thresholds, investors can make faster and more efficient trade calls, which can end up minimizing possible losses.

Machine Learning is not going anywhere. And as self learning models become more efficient, and the costs to integrate machine learning lower, you can expect machine learning to become a more core aspect of the fintech industry.