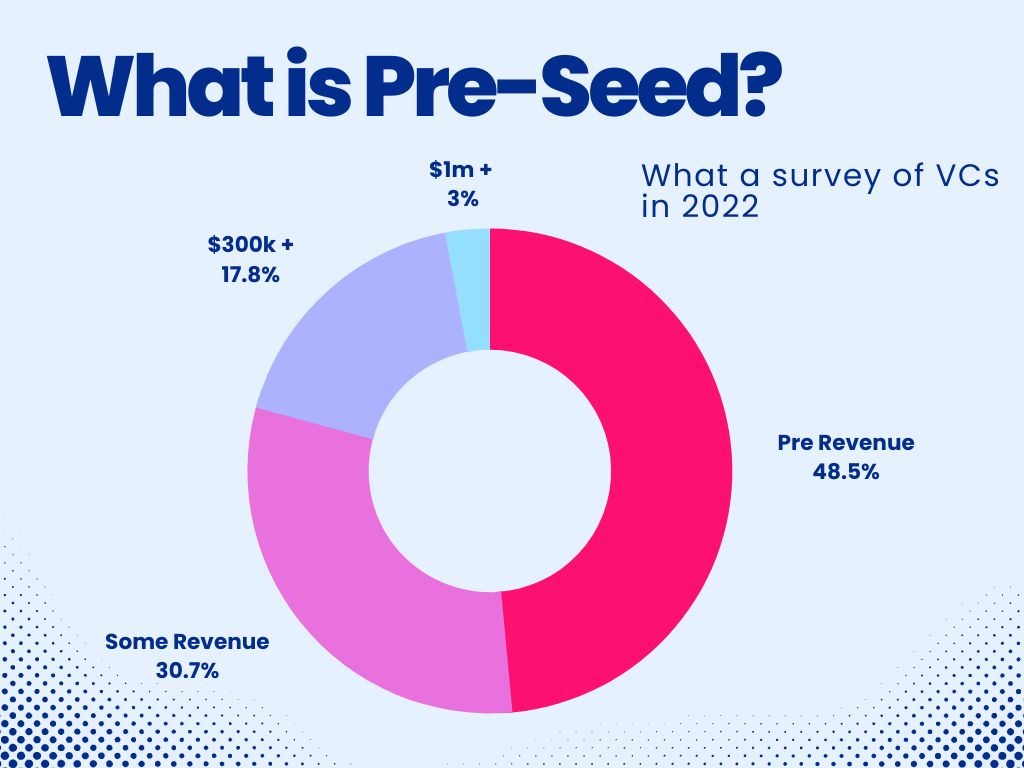

Chances are you’ve heard of seed funding, but what is pre-seed funding? Entrepreneurs consider pre-seed funding to be the earliest form of funding. But what about investors? What do startups need to have to be considered pre-seed? In many cases, pre-seed capital is funding only an idea and nothing more.

So, if you’re starting a business and you’re thinking of raising a pre-seed round of capital, here’s everything you need to know.

So what is pre-seed funding?

Pre-seed funding is the first stage of venture capital. It’s used to help businesses take their ideas and start to turn them into a business. It’s usually contributed by angel investors, venture capitalists, or other private investors who are willing to back entrepreneurs before they have any tangible products or services available. Pre-seed capital can be used for many things such as researching the market, developing prototypes, hiring team members, and more.

What’s the difference between pre-seed and seed funding?

The difference between pre-seed and seed funding is that seed funding occurs after the development of an initial product or service. This means that companies will generally need to demonstrate traction (99 times out of 100, that means customers) and some sort of revenue model before they’re ready for seed funding.

When should you raise pre-seed funding?

When to start raising pre-seed funding depends on how far along you are with your business. Generally, if you have a basic idea and some initial market research, then it’s time to start looking for investors. You should also have a solid plan for how you will use the money and what milestones you want to accomplish with it.

In order to be considered “ready” for pre-seed funding, startups generally need to demonstrate that their concept is feasible, that they can execute the plan, and that there is an opportunity in the marketplace. Additionally, companies should provide investors with detailed financial projections that show how they will generate revenue in the future.

What are the Pros and Cons of pre-seed funding?

The pros of pre-seed funding include that it can help startups get their business off the ground more quickly, as well as provide capital to develop new products and services. In addition, pre-seed funding from investors can also give entrepreneurs access to mentorship and advice that could be invaluable in the early stages of a business.

The cons of pre-seed funding include that it’s often difficult to secure investments at these early stages of development. Additionally, because investors are taking a risk on an unproven concept or product, they may require significant equity or other concessions in exchange for their investment. Finally, there is no guarantee that pre-seed investments will yield profitable returns so startups should understand the risks before proceeding.

Types of pre-seed funding

There are several options available to you when it comes time secure capital in your start-up’s pre-seed round. The most popular being family and friends, followed by venture capitalists who specialize early on, then angel investors who have a high risk tolerance.

Here’s a breakdown of the most popular options for pre-seed funding:

- Family and Friends – By far the most popular (and suggested) funding option for pre-seed startups. Most founders invest personal wealth and ask family and friends to get involved. But what if you don’t have rich friends or connections? Then you’re out of luck. These days, suggesting this is a little tone-deaf, given the socio-economic disparities that exist in the startup industry.

- Venture Capitalists – Some venture capitalists specialize in getting into startups as early stage investors. They’re picky and success rates are low. And now they’re asking for more ownership and providing less capital.

- Angel Investors – Aka wealthy individuals investing in startups. Pre-seed angel investors often look for big risks and tend to invest between $10,000 to $100,000 in startups during the pre-seed phase, depending on how well they know you and how confident they are in your business idea (and you).

- Crowdfunding – There are over 500 crowdfunding platforms out there right now. Crowdfunding involves individual people (meaning unaccredited investors) from around the world donating small amounts to fund an idea. These are effective tools, but they rely heavily on marketing your brand to generate interest.

- Incubators – Incubators focus more on providing other business services, such as free resources (like $500 of free hosting), office space, mentorship, and access to active investors. They may offer a small amount of funding, but are more focused on providing resources.

- Accelerators – Accelerators concentrate on fast scaling for ideas with high growth potential. They tend to focus more on startups that can show traction and some accelerators even offer pre-seed capital. Usually it’s between $5,000 to $10,000.

Yes, there are limited options available for pre-seed money, and that’s unfortunate. But most traditional financial organizations (aka banks and credit unions) will not invest in an idea. They want to invest in a viable business, which is why they don’t become available until founders start looking into later rounds of funding.

Should startups get pre-seed funding?

Ultimately, whether your startup should raise pre-seed funding depends on your specific situation. If you have the right business concept, the right team and a solid plan for how the money will be used, then pre-seed funding can be a great way to get your business off the ground. However, entrepreneurs should also be aware of potential risks and understand what they’re signing up for before proceeding with this type of capital raise.